The Only Guide for Health Insurance In Toccoa Ga

Wiki Article

Automobile Insurance In Toccoa Ga for Dummies

Table of ContentsThe Final Expense In Toccoa Ga DiariesRumored Buzz on Affordable Care Act Aca In Toccoa Ga7 Easy Facts About Health Insurance In Toccoa Ga Described

Ad You could assume all monetary experts would certainly place their customers' demands very first and stay clear of problems of interest however that's not constantly the case. The fiduciary criterion of treatment likewise understood as fiduciary responsibility is a guideline that requires economic advisors put their clients' best rate of interests ahead of their own, also if that indicates suggesting techniques that could lower their own payment.

Registered financial investment consultants have this commitment while movie critics claim brokers do not, despite a recent regulation that was intended to reinforce these standards. Fulfilling the fiduciary basic issues most when you're hiring a financial consultant to spend and choose monetary items on your part (https://www.bark.com/en/us/company/thomas-insurance-advisors/1Vw6z/). If you're just seeking assistance building a regular monthly budget, this issue is most likely not as important

You can do some excavating into someone's experience and see whether possible consultants have actually encountered any kind of corrective actions.

Everything about Life Insurance In Toccoa Ga

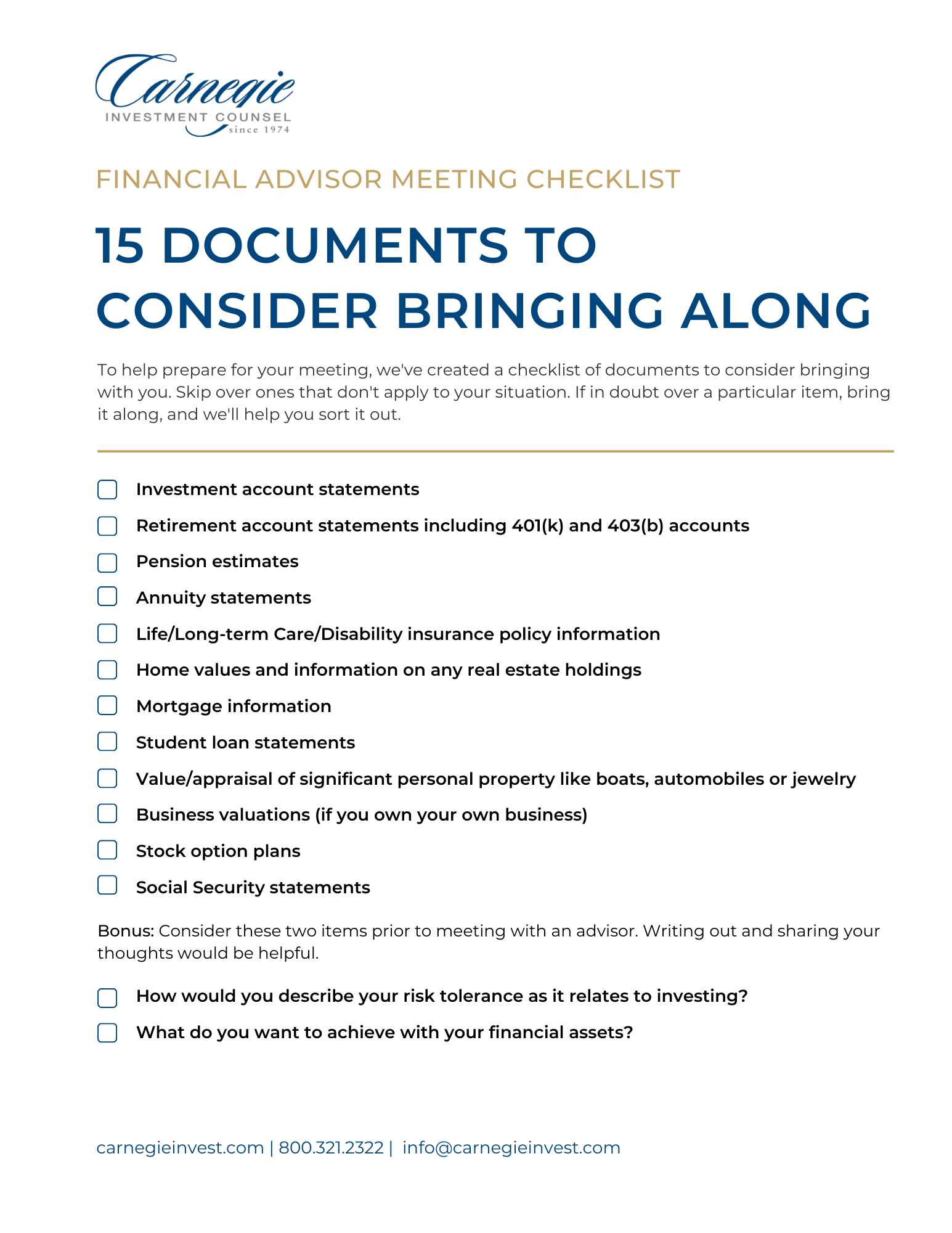

How do you choose investments and products for your clients? Do you have a fiduciary obligation to your customers? You need to likewise ask concerns regarding your specific circumstance: Claim you're a person that is brand name new to economic preparation.

If an advisor doesn't desire to go over these information, move on to a person else. It's essential you select an advisor that is clear regarding just how they'll handle your financial resources and address any concerns you may have.

The table listed below details some crucial differences in extent of technique, qualifications and charge structures. Might cover a wide variety of solutions, consisting of those of an economic organizer, plus others, such as tax suggestions, investment portfolio administration, economic planning, insurance products Usually only supplies monetary planning, e. g (http://www.place123.net/place/thomas-insurance-advisors-toccoa-united-states)., analyzing budgets, short and long-lasting financial goal-setting, retired life cost savings plans, estate planning Works with individuals, companies Works with individuals, organizations Some common qualifications consist of Licensed Monetary Planner (CFP), Certified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT), Chartered Financial Analyst (CFA), Qualified Financial Investment Monitoring Analyst (CIMA) Managed by the CFB Board, most typical certification is Qualified Financial Coordinator (CFP) Variety of cost structures, including compensations on monetary products, level fees and portion of assets under monitoring (AUM) Prices are usually hourly or flat cost Prior to the Covid-19 pandemic, financing specialists prioritized in-person conferences with their customers and the bulk of the therapy was still done in person, but this has actually altered with the pandemic

Customer protection supporters have long been promoting an extra stringent and clear fiduciary criterion throughout the industry. However they've been let down with much of the relocations made to advance the defense of individual financiers. In 2019, the SEC carried out the brand-new Law Best Rate Of Interest (Reg BI). The brand-new code of conduct holds that economic consultants and broker-dealers have to: Only recommend items that remain in the consumer's best passion Plainly identify any possible conflict of interest or financial incentive the broker-dealer may have.

The Main Principles Of Commercial Insurance In Toccoa Ga

It, for that reason, doesn't safeguard financiers to the extent that a true fiduciary regulation would certainly. The SEC said it will be specified on a case-by-case basis, yet absence of clarity "just serves to develop unnecessary uncertainty and unneeded risk direct exposure for both experts and financiers," Watkins states. The very best method to shield yourself is to choose an economic expert that voluntarily reduces the disputes of interest in their business model and voluntarily abides by a fiduciary requirement Full Report more than the one the SEC imposes, states Barbara Roper, director of financier security for the Customer Federation of America.It's additionally vital to bear in mind that brokers might have a various pay framework than consultants. They may make money by offering you products that are alright for you (and will provide them a larger payment) but are not necessarily the most effective for you - Home Owners Insurance in Toccoa, GA. Do not be timid about asking potential advisors how they're made up

, conversely, means the advisor is limited in what they can offer, often because they're obtaining some kind of payment from whoever is marketing the financial investment, like a mutual fund supervisor (https://www.bitchute.com/channel/6nluIOweAbIN/). It might be best to actively discover a person who is "open style," and look for consultatory firms that are fee-only, paid exclusively by the client

Report this wiki page